Last Tuesday at the Harvard Club, we hosted a lively and thoughtful panel discussion on the current state of the variable annuity industry. Featuring leading minds from prominent insurance companies, the standing-room-only crowd got a rare look at the ways these firms are dealing with the post-crisis market in terms of statutory accounting, risk transfer, product design, and infrastructure.

Here are some of the highlights:

On risk management

The financial crisis created new challenges for VA risk managers as delta hedging strategies proved inadequate and correlations rose across the board, requiring insurance companies to re-evaluate risk priorities. Before the crisis, the primary focus was on economic risk, with GAAP volatility also heavily influencing decisions. Post-crisis, statutory considerations have increased dramatically, with companies focusing more on reserves and capital.

The industry also learned a great deal more about types of risk that can’t be directly hedged, but instead must be managed—such as basis risk, correlations, counterparty exposure, and transaction costs. This has led to changes in product offerings and hedging strategies.

On product design

To stabilize the VA market, the trend has been to scale back on guarantee features, adjust policy terms, restrict investment options, and even suspend sales of certain products. A proposed alternative to reducing policyholder value was to look at the problem in terms of managing costs: for example, using passively managed index funds to reduce basis risk, or constant-volatility funds to tighten hedge effectiveness.

In addressing the cost of increasing correlations in times of financial stress, one proposed option was to include a modest allocation to alternative asset classes, like managed futures—a true zero-correlated asset class. The diversification benefit of managed futures helps reduce account value volatility, as well as the fair rider premium.

One major debate rippling through the industry is the practice of internal hedging—including “natural hedges” within the company’s product lines rather than explicit hedges within the risk management function. While the panel didn’t offer a consensus opinion, it was noted that it’s important to bear in mind the cost-effectiveness of this approach to the consumer.

On infrastructure

The insurance industry has generally lagged investment banking in terms of the sophistication of derivatives usage. That tide has turned, with VA hedging strategies employing some of the most exotic instruments in the market. For many companies, this may require additional investment in IT infrastructure, human capital and analytics capabilities to enable the kinds of complex computations required to value and risk-manage these types of trades.

On modeling

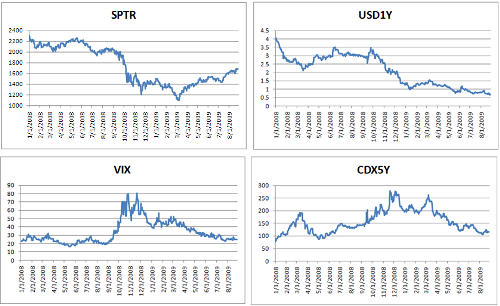

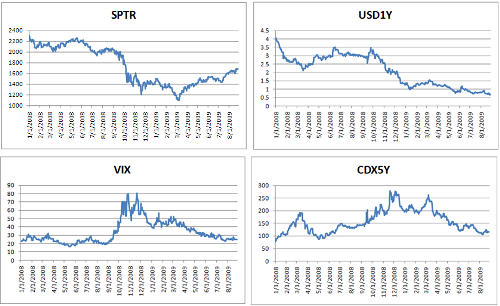

As hedging strategies have grown more complex, companies are employing a broader range of instrument types and moving toward more advanced models—Black-Scholes simply doesn’t cut it anymore. That’s because VAs are sensitive to numerous market dynamics, including equities, volatility, interest rates and spreads. But the conventional model (Black-Sholes/Hull-White) really only addresses equity and rates movements, completely neglecting stochastic volatility and credit.

By introducing sophisticated modeling techniques, such as the ones available through the Numerix hybrid model framework, it’s possible to improve the richness, and reality, of modeling market dynamics. For example, Numerix actuary Mark Hadley demonstrated how pricing a typical withdrawal benefit policy under a fully market-consistent hybrid valuation model resulted in a 30-40% increase in the fair rider premium, relative to the valuation from a conventional model.

Ignoring volatility and credit factors in financial models would have been a bad idea during last year’s crisis (clockwise from top left): equity (S&P 500), interest rates (USD 1Y Swaps), credit spreads (5Y CDX), and volatility (VIX Index)

Speed is obviously a consideration when using advanced models. When one audience member asked how fast these calculations could be performed, he was surprised at Mark's answer: Numerix can project 1,000 paths over 50 years AND do all of the cash flow calculations — all in about 0.3 seconds. Further run-time improvements can be accomplished with Numerix’s suite of proprietary variance reduction techniques, which require only about 200 paths per policy for convergence.

The issue of how to properly model policyholder behavior also came up. Mark pointed out that moving from sub-optimal policyholder behavior to optimal policyholder behavior has a significant impact on risk-neutral valuation and Greeks.

Conclusion

It’s important to keep in mind that the VA industry is still in the process of exploring effective risk strategies, and there will be growing pains along the way. The key is to see this as an opportunity to innovate—a chance to discover unorthodox solutions to some very challenging questions.

A great example is to not always look at hedging in terms of “I sold an option, so I should buy an option.” New techniques continue to emerge that address enterprise risk and product strategy in unconventional ways. And while advanced models can be helpful, don’t neglect the basics—from getting your forward curves right to making sure your company has a driving vision for how VAs fit in the overall business strategy.

Thanks to our esteemed panel: Doug French (Ernst & Young), Jim Lloyd (Société Générale), Nicholas Mocciolo (HIMCO), Andrew Rallis (MetLife), and Mark Hadley (Numerix).

To learn more about this topic and continue the discussion with other VA professionals, head over to Quant Connection (Numerix’s discussion forum). Or if you’d like to learn more about Numerix models and solutions for insurance companies, feel free to contact us.

We’d like to send a special thank you to our partners at Microsoft High Performance Computing for their donations to the event’s raffle. Somewhere out there, an actuary is having a brighter day listening to tunes on his new Zune.

- See more at: numerix-blog/2009/12/sharing-thoughts-on-variable-annuities-in-the-new-era#sthash.Md5newqs.dpuf