Begin your exploration

Valuation

Optimize your derivatives pricing and valuation with a solution that promises speed, scalability, and efficiency. Streamline every step of your valuation process, from trade capture to model validation, for a seamless, integrated portfolio management experience.

Market Risk

Transform your firm’s approach to market risk with the most comprehensive suite of analytics for a holistic view across the enterprise. Designed to empower users with on-demand insights, enabling more informed trading and risk decisions with advanced scenario analysis and stress testing capabilities.

XVA & Counterparty Risk

The industry’s most sophisticated analytics, enabling traders to manage counterparty risk exposures, integrate XVAs into deal prices, and execute even the most complex deals at the right price.

OTC Trading

From structuring and pricing to hedging, risk analysis, lifecycle management, and P&L attribution, our real-time infrastructure empowers issuers and distributors to seize market opportunities with confidence.

Structured Finance Trading & Risk

Customizable analytics, seamless integration, robust pricing, and precise risk management for your fixed income and structured finance portfolios.

Banking Asset Liability Management

Our Asset Liability Management (ALM) solution bridges the gap between portfolio economics and accounting, revolutionizing risk measurement and decision-making for fixed income portfolios.

Related resources

Turbocharging Tech for Next-Level Risk Analytics

Download the latest Risk.net whitepaper to read more about the challenges and key themes facing risk managers, and how they are using technology to uncover opportunity.

‘Finalized,’ but Far from the Finish Line – Preparing for the Next Evolution of FRTB

While the final FRTB text has some important changes from the fourth QIS of July 2015, including an extra year for implementation (with a new deadline of January 1st, 2019 for local translation and Dec 31st for latest date for 1st report submission by the financial institutions) and a reduced Residual Risk Add-on—many of the key rules in the framework remain unchanged from prior versions. Derivate market participants are finding the scope and complexity of the framework quite daunting.

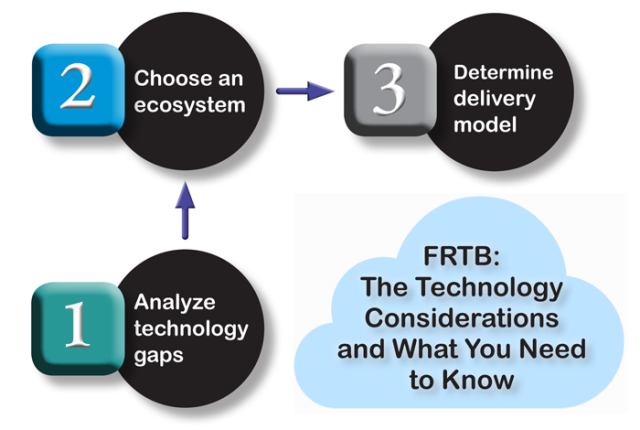

FRTB: The Technology Considerations and What You Need to Know

FRTB will manifestly change the way banks run their trading business; banking infrastructure must rise to new demands. With band-aided, legacy systems becoming costly to adapt and falling short, this paper helps banks to better understand the technology architecture needed to meet the new flexibility, agility, scalability and computational requirements.