Risk Magazine Cutting Edge Article | Machine Learning: Deep Asymptotics

In this research, Drs. Alexandre Antonov, Michael Konikov and Vladimir Piterbarg overcome limitations and develop a new type of neural network that incorporates large-value asymptotics, allowing explicit control over extrapolation.

Risk Magazine Cutting Edge Article | Multi-curve Cheyette-style models with lower bounds on tenor basis spreads

This article presents a general multi-curve Cheyette-style model that allows precise control over tenor basis spreads.

Risk Magazine Cutting Edge Article | A new arbitrage-free parametric volatility surface

In this Cutting Edge research article, published in the September 2018 Issue of Risk Magazine, Drs Alexandre Antonov, Andrew McClelland and Serguei Issakov discuss how algorithmic differentiation can efficiently compute sensitivites of future trade values.

Neural Networks with Asymptotics Control

Artificial Neural Networks (ANNs) have recently been suggested for use in derivatives pricing applications as accurate and fast approximators to various financial models.

STIRs and OIS Futures in the Hull-White Model

This paper derives exact formulas and their simple approximations for STIRs and OIS futures convexity adjustment under the one-factor Hull-White model which can be efficiently used in curve stripping.

Risk Magazine Cutting Edge Article | MVA Future IM for Client Trades and Dynamic Hedges

Alexandre Antonov, Serguei Issakov and Andy McClelland propose that IM for both sides should be forecast and reflected in MVA.

Risk Magazine Cutting Edge Research Article | Efficient Simm-MVA calculations for callable exotics

In this Cutting Edge research article published in the September 2018 Issue of Risk Magazine, Drs Alexandre Antonov, Andrew McClelland and Serguei Issakov discuss how algorithmic differentiation can efficiently compute sensitivities of future trade values.

Risk Magazine Cutting Edge Research Article | Pathwise XVA Greeks for Early-Exercise Products

Using a new Numerix technique, Greeks can be computed almost as quickly as the time it takes to price the derivatives.

Efficient SIMM-MVA Calculations for Callable Exotics

This paper introduces a method which avoids nested calls to the pricing function, similar to the use of least-squares Monte Carlo (LSMC) for producing future exposures.

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

PV and XVA Greeks for Callable Exotics by Algorithmic Differentiation

We generalize the algorithmic differentiation method proposed by Antonov (2016) from price Greeks to XVA Greeks.

Algorithmic Differentiation for Callable Exotics

Dr. Alexandre Antonov studies the algorithmic calculation of present values greeks for callable exotic instruments.

Risk Magazine Cutting Edge Research Article | Funding Valuation Adjustment for General Instruments

In this Cutting Edge research article, published in the November 2015 Issue of Risk Magazine, Drs. Alexandre Antonov, Marco Bianchetti and Ion Mihai develop a universal and efficient approach to numerical FVA calculation.

"Hot-start" Initialization of the Heston Model

The most straightforward way of initializing a hidden variable is by specifying its equilibrium distribution, which assumes that this component of the multifactor process has been started well before the observable part. As a practical example, the Heston model is considered.

Risk Magazine Cutting Edge Research Article | The Free Boundary SABR: Natural Extension to Negative Rates

In this Cutting Edge article published in the September 2015 Issue of Risk Magazine, Alexandre Antonov, Michael Konikov, and Michael Spector have presented a natural generalization of the SABR model to negative rates.

Research In Brief | Negative Rates: The Challenge and the Opportunity

Dr. Ion Mihai, explores how negative interest rates have recently become a critically important issue in finance.

Advanced Analytics for the SABR Model

In this paper, authors Alexander Antonov, PhD, and Michael Spector, PhD, present advanced analytical formulas for SABR model option pricing.

Backward Induction for Future Values

Drs. Alexandre Antonov, Serguei Issakov and Serguei Mechkov generalize the American Monte Carlo method to efficiently calculate future values (or exposures) of derivatives using an arbitrage-free model.

Analytic Approximation for Prices of American Options, Time-Dependent Settings, Proportional and Discrete Dividends: The Decoupled Volatility Framework

In this article, we present the analytical approximation of zero-coupon bonds and swaption prices for general short rate models.

Risk Magazine Cutting Edge Article | Machine Learning: Deep Asymptotics

In this research, Drs. Alexandre Antonov, Michael Konikov and Vladimir Piterbarg overcome limitations and develop a new type of neural network that incorporates large-value asymptotics, allowing explicit control over extrapolation.

Risk Magazine Cutting Edge Article | Multi-curve Cheyette-style models with lower bounds on tenor basis spreads

This article presents a general multi-curve Cheyette-style model that allows precise control over tenor basis spreads.

Risk Magazine Cutting Edge Article | A new arbitrage-free parametric volatility surface

In this Cutting Edge research article, published in the September 2018 Issue of Risk Magazine, Drs Alexandre Antonov, Andrew McClelland and Serguei Issakov discuss how algorithmic differentiation can efficiently compute sensitivites of future trade values.

Neural Networks with Asymptotics Control

Artificial Neural Networks (ANNs) have recently been suggested for use in derivatives pricing applications as accurate and fast approximators to various financial models.

STIRs and OIS Futures in the Hull-White Model

This paper derives exact formulas and their simple approximations for STIRs and OIS futures convexity adjustment under the one-factor Hull-White model which can be efficiently used in curve stripping.

Risk Magazine Cutting Edge Article | MVA Future IM for Client Trades and Dynamic Hedges

Alexandre Antonov, Serguei Issakov and Andy McClelland propose that IM for both sides should be forecast and reflected in MVA.

Risk Magazine Cutting Edge Research Article | Efficient Simm-MVA calculations for callable exotics

In this Cutting Edge research article published in the September 2018 Issue of Risk Magazine, Drs Alexandre Antonov, Andrew McClelland and Serguei Issakov discuss how algorithmic differentiation can efficiently compute sensitivities of future trade values.

Risk Magazine Cutting Edge Research Article | Pathwise XVA Greeks for Early-Exercise Products

Using a new Numerix technique, Greeks can be computed almost as quickly as the time it takes to price the derivatives.

Efficient SIMM-MVA Calculations for Callable Exotics

This paper introduces a method which avoids nested calls to the pricing function, similar to the use of least-squares Monte Carlo (LSMC) for producing future exposures.

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

PV and XVA Greeks for Callable Exotics by Algorithmic Differentiation

We generalize the algorithmic differentiation method proposed by Antonov (2016) from price Greeks to XVA Greeks.

Algorithmic Differentiation for Callable Exotics

Dr. Alexandre Antonov studies the algorithmic calculation of present values greeks for callable exotic instruments.

Risk Magazine Cutting Edge Research Article | Funding Valuation Adjustment for General Instruments

In this Cutting Edge research article, published in the November 2015 Issue of Risk Magazine, Drs. Alexandre Antonov, Marco Bianchetti and Ion Mihai develop a universal and efficient approach to numerical FVA calculation.

"Hot-start" Initialization of the Heston Model

The most straightforward way of initializing a hidden variable is by specifying its equilibrium distribution, which assumes that this component of the multifactor process has been started well before the observable part. As a practical example, the Heston model is considered.

Risk Magazine Cutting Edge Research Article | The Free Boundary SABR: Natural Extension to Negative Rates

In this Cutting Edge article published in the September 2015 Issue of Risk Magazine, Alexandre Antonov, Michael Konikov, and Michael Spector have presented a natural generalization of the SABR model to negative rates.

Research In Brief | Negative Rates: The Challenge and the Opportunity

Dr. Ion Mihai, explores how negative interest rates have recently become a critically important issue in finance.

Advanced Analytics for the SABR Model

In this paper, authors Alexander Antonov, PhD, and Michael Spector, PhD, present advanced analytical formulas for SABR model option pricing.

Backward Induction for Future Values

Drs. Alexandre Antonov, Serguei Issakov and Serguei Mechkov generalize the American Monte Carlo method to efficiently calculate future values (or exposures) of derivatives using an arbitrage-free model.

Analytic Approximation for Prices of American Options, Time-Dependent Settings, Proportional and Discrete Dividends: The Decoupled Volatility Framework

In this article, we present the analytical approximation of zero-coupon bonds and swaption prices for general short rate models.

Impacts of FRTB’s Fragmented Implementation

Join Franck Rossi of Numerix as he provides an update on FRTB challenges due to the heterogeneous timelines and rules.

Quants in the Cloud: Timely and Optimized Pricing and Risk Decisioning

Discover how to achieve better pricing and risk decisions with high performance calculations, rapid applications building and quantitative sandboxing using NxCore Cloud, a cloud-native development platform.

FINCAD Analytics Suite: Real-Time Pricing & Risk of 0DTE Options

Learn about the unique risk characteristics of 0DTE options, and how to use FINCAD Analytics Suite for Excel to accurately price these options and assess the related market risks.

Charting the Course for Structured Credit Markets in 2024

In December 2023, Risk.net gathered a panel of experts to provide insights into the structured mortgage sector and other interest rate-sensitive structured products, highlighting the key risk factors and unique market dynamics that shape them.

FINCAD Analytics Suite: Quantitative Trading Strategies for Corporate Bonds

FINCAD Analytics Suite: Quantitative Trading Strategies for Corporate Bonds

Tech Revolution: Equipping Institutions For Risk and Regulatory Challenges

In October 2023, Risk.net gathered a panel of experts to discuss the game-changing impact of cloud technology and data analytics, empowering institutions to enhance their calculations and cut operational costs.

FINCAD Analytics Suite: Current Rate Dynamics & RFR Curve-Building

Get a first-hand look at FINCAD Analytics Suite for Excel’s powerful curve-building capabilities, enabling firms to easily construct curves for risk-free rates (RFRs) in a fluctuating interest rate environment.

How APAC Banks Can Leverage FRTB-SA for Effective Market Risk Management

An overview of FRTB-SA and how banks can use it for market risk management, including day-to-day risk monitoring, drilldown analysis, capital allocation, what-if analysis, and others

NxCore for XVA: An Advanced XVA Engine & Quant Sandbox

Learn how Numerix’s NxCore product, a cloud-native development platform, can be used for high performance XVA calculations and quantitative sandboxing.

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

XVA Dynamics from a Buy-Side Perspective: The Latest Strategies and Insights

In October 2023, Risk.net gathered a panel of experts to discuss key aspects of XVA from a buy-side perspective, shedding light on strategies to navigate this complex terrain, helping to reduce trading costs and ensure access to liquidity from a wider panel of banks.

PnL Explain: Strategic Trading Book Insights for Traders, Risk Managers & Other Stakeholders

Learn how the PnL Explain analytics in Numerix Oneview can provide you with critical insights to inform your daily trading and risk decisions.

FRTB-SA Analytics: Transforming a Regulatory Obligation into an Opportunity

Learn how Numerix’s FRTB-SA analytics can help banks uncover additional business benefits beyond just regulatory compliance.

Cloud Control: Optimising Cloud for Risk Management Gains

In May 2023, Risk.net hosted this exclusive session with Executive Director of Numerix, Obaid Dehlavi, which covers expert insight on the challenges of working in the cloud, lift and shift, managing scale and more.

Zero-day options: ticking time bombs or high alpha trades?

In June 2023, Risk.net gathered a panel of experts to provide their perspectives on 0TDE options.

A Step-by-step Guide to Using ChatGPT to Build a Simple Risk Application

Can ChatGPT be leveraged by capital markets firms, and if so, how? Join James Gavin of Numerix as he walks through a practical example of using ChatGPT to calculate Value-at-Risk (VaR) on a swap portfolio and building a lightweight VaR application.

Future Directions for Capital Markets Technology in the Digital/AI Revolution

This webinar is part of Numerix's ongoing “Derivative Insider” series. In this installment, Neil Chinai, Operating Partner at Sand Hill East, joins Numerix’s CMO James Jockle to discuss his outlook on promising new capital markets technologies.

FRTB in a Fast-Changing World: Is the Regulation Still Relevant?

An update on FRTB progress around the world, as well as challenges and quirks of the regulations that practitioners should be aware of as they finalize their preparations.

Risk.net | D-day for the Rates Market: Solving the Outstanding Issues in US Libor Transition

In March 2023, Risk.net gathered a panel of experts to discuss the issues facing the market, the progress made so far and the outstanding issues facing the 'new look' rates market.

Exos Financial Uses Numerix CrossAsset SDK Python to Scale Up Risk Analytics

In this video, Philippe Hatstadt, Chief Risk Officer of Exos Financial, discusses why and how his firm used Numerix CrossAsset SDK Python to fill a need for a comprehensive multi-asset and derivatives risk management analytics and valuation library that it could integrate into its own proprietary risk and valuation platform.

OCBC Bank Scales Business and Mitigates Risk with Numerix Oneview

During the course of its nearly 10-year partnership with Numerix, OCBC Bank has faced a number of challenges it engaged Numerix to address. The bank required a platform that could help it meet demand for products with more innovative features within the structured products market and which integrated a sophisticated risk management process.

Samsung Fire and Marine Insurance Case Study

Samsung Fire & Marine Insurance (SFMI), a multinational insurance company based in central Seoul, South Korea, selected the Numerix Economic Scenario Generator for producing its risk neutral economic scenarios. With its principal products including automobile, long-term and commercial insurance, enterprise risk management, and annuities—SFMI is the largest Property and Casualty Insurer in Korea.

Mazars Case Study

Mazars, an international, integrated and independent organization, specializing in audit, accountancy, tax, legal and advisory services selected Numerix CrossAsset analytics to be used within Mazars Actuariat by the Quantitative and Actuarial teams for derivatives pricing, modeling and insurance actuarial work.

Cathay United Bank Case Study

Designed specifically for TMUs, Numerix Treasurer helps Cathay United Bank differentiate its Customer Service and enhance overall operational efficiency while providing comprehensive, accurate and timely regulatory reporting.

Swedbank CrossAsset/Model Validation Case Study

Swedbank selected Numerix CrossAsset for pricing complex structures and model validation. The Numerix CrossAsset analytics platform provides a framework for structuring, pricing and managing complex derivatives and structured products, allowing users to calculate prices and Greeks and perform scenario analysis using real-time data.

pbb Deutsche Pfandbriefbank XVA/CVA Case Study

pbb Deutsche Pfandbriefbank selected Numerix for its firm-wide CVA calculations to assist with regulatory compliance. Chosen for its accurate, near real-time credit risk valuations, Numerix XVA/CVA leverages its industry-leading CrossAsset analytics to deliver a highly flexible, transparent solution for CVA and potential future exposure (PFE).

OTP Bank CrossAsset/Model Validation Case Study

OTP Bank leverages Numerix CrossAsset for model validation, pricing complex derivatives and drilling down to comprehensive pre- and post-trade risk analysis, including Greeks, scenarios and stress testing.

Kerius Finance CrossAsset Risk Case Study

Kerius Finance integrated Numerix CrossAsset into its proprietary platform for risk analysis, customized reporting and hedge advisory services – including proposals and structuring of hedging, financing and investment strategies.

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

HDFC Bank Market Risk Case Study

Numerix provided HDFC Bank with the only third-party risk management solution flexible and scalable enough to meet its requirements, combined with a unique level of support provided by its dedicated Numerix Mumbai office.

Double No Touch and Other FX Option Strategies for Low Volatility Markets

This case study covers various foreign exchange (FX) option strategies that take advantage of low volatility market conditions. Specifically, it explores the risks, benefits and mechanics of traditional strategies, such as straddles and strangles, but also focuses on and examines more advanced FX option strategies, such double no touch (DNT) options, European range bet (ERB) options and DNT options in emerging markets.

Discover the Numerix Difference

Learn about our front-to-risk technology suite and how we're helping traders and risk managers actively value, manage risk and hedge their portfolios.

Numerix: Pushing Boundaries to Create Breakthrough Technology

Learn why Numerix is the leading provider of capital markets technology

Numerix Oneview for Trading

In this short animated video, discover how Numerix Solutions provides holistic trading analysis with Oneview for Trading.

What is Numerix Oneview?

Numerix Oneview offers solutions that help manage the complexities of the changing capital markets landscape, effectively manage risk and build a new competitive edge.

Numerix Oneview for XVA

In this short animated video, discover how Oneview’s next-generation technology provides the edge they need to compete and win in their markets.

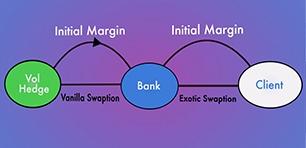

Steering the Initial Margin Process to Determine Full MVA Cost

How IM requirements arise from client trades and the hedge trades they necessitate

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

Navigating AI Adoption in Finance with Finpilot

In this episode, host Jim Jockle is joined by co-founder and CEO of Finpilot, Lakshay Chauhan. Described as ChatGPT for financial questions, Finpilot uses AI to pull information out of unstructured financial data.

Speeding up Capital Markets Through Quicker Capital Raising

In this episode, host Jim Jockle is joined by Rodney Reisdorf, the CEO and Co-Founder of Verivend, dubbed the "Venmo of private capital.”

Navigating the New World of Private Credit Opportunities and Strategies

In this episode, host Jim Jockle dives into the transformative impact of technology on the finance sector with Prath Reddy, president at Percent.

Crypto and Capital: The Impact of Blockchain on the Financial Industry

In this episode, host Jim Jockle is joined by Igor Telyatnikov, CEO and co-founder of AlphaPoint, to explore blockchain's potentially transformative impact on finance, its role in financial inclusion, and its potential to revolutionize asset tokenization.

The Impact of Low-Code Technology on the Financial Industry

In this episode, host Jim Jockle is joined by Brian Sathianathan of Iterate.ai to discuss if low-code technology is well-suited for the financial industry.

Revolutionizing Finance: A Deep Dive into Fintech Innovations

In this episode, host Jim Jockle is joined by Alex Yavorsky of Jefferies to dissect the larger picture of how innovative technologies and forward-thinking companies are reshaping financial markets.

Dr. Merav Ozair on if Blockchain could enable Responsible AI

In this episode, host Jim Jockle is joined by Dr. Merav Ozair, a global leading expert on emerging technologies, who says the answer to implementing AI responsibly could lie in the use of another popular technology, Blockchain.

Attracting, Retaining and Engaging the Gen Z Workforce

In this episode, host Jim Jockle is joined by Bruce Martin, the CEO of Tax Systems, and Keryn Koch, the Chief HR Officer for Numerix, to discuss how to attract and retain the newest addition to the workforce, Gen Z.

AI Regulation and the Finance Industry

In this episode, host Jim Jockle is joined by Professor Michael Wellman, one of the most influential voices on AI regulation, to discuss how we can emphasize AI’s compliance with existing laws, understand the implications, all while continuing to promote quick innovation.

Subscribe to our monthly newsletter to get exclusive resources from Numerix.

Understanding the Quick Rise and Wide Impact of AI and MLs

In this episode, host Jim Jockle is joined by AI export, Adam Hyland to discuss the reasons behind the burst in popularity of ChatGPT and what the future might hold for AI and MLs.

Track these Trends: 2024 Market Insights with Coalition Greenwich

In this episode, host Jim Jockle and Kevin McPartland of Coalition Greenwich discuss the 2024 global finance landscape ad the trends you need to be tracking.

Technology That is Captivating the Finance Industry with Broadridge

In this episode, explore the cutting-edge technologies captivating the finance industry's investments and attention

Decoding Cloud Adoption in Finance with Elle Ellis and Kalyani Koppisetti of AWS

The cloud has revolutionized how businesses operate, bringing forth a wave of innovation that has transformed scalability, cost-efficiency, flexibility, and collaboration.

Unraveling the Intricacies of Data and Capital Markets with Scott Fitzpatrick

Dive into the intricate world of capital markets data in this episode.

Blockchain's Potential on Capital Markets with Graeme Moore

Blockchain is a technology that garners a lot of interest from the finance industry, but could the complex world of asset tokenization transform banking?

Navigating the Turbulent Energy Market with Karl Sees

The episode is a deep into the shifting landscape of the energy and commodities markets.

The Impact of AI and ML on Investing with Chandini Jain

Imagine a world where artificial intelligence dictates your financial decisions; it might be just around the corner.

Venturing into Virtual Reality and Finance with Lyron Bentovim

What if you could see data differently? Not just as numbers on a 2-D screen but as images that tell a story.

Portfolio Management Using Advanced Market & Credit Simulations

Demo content for teaser description