overview

About The Numerix CrossAsset Library

The Numerix CrossAsset library offers the industry’s most comprehensive collection of models and methods, allowing institutions to price any conceivable instrument using the most advanced calculations. Users also gain access to a wide range of calibration options for generating market-consistent valuations.

With an infinitely flexible architecture for defining bespoke deals—and the ability to integrate your own internal models—Numerix CrossAsset enables the deployment of a unified pricing and risk solution for all your derivative and fixed income positions across all trade types.

Optimized Numerical Methods

Pricing derivatives often involves intense computations. Our quantitative analysts have developed methods that have been optimized for speed and accuracy, enabling rapid calculations for even the most complex instruments.

The Industry’s Only Independent Solution for Hybrids

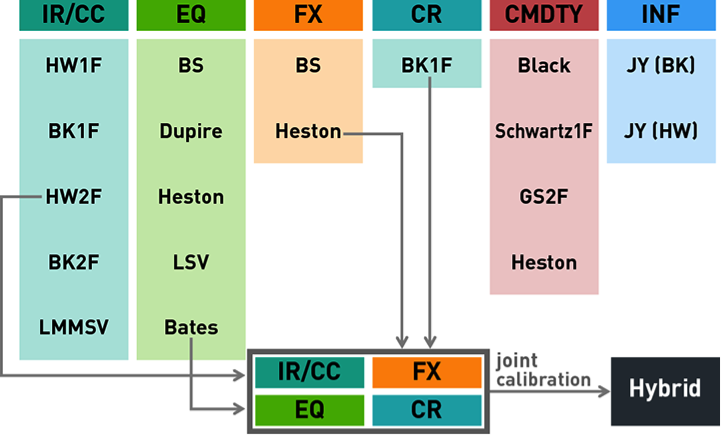

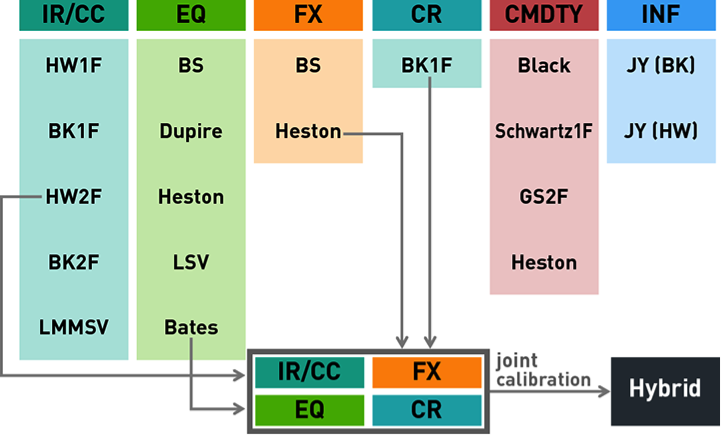

Through our experience in cross-asset modeling, the Numerix quantitative research team has developed a unique hybrid model framework that produces accurate valuations for instruments consisting of multiple underlyings, such as structured notes and variable annuities. This process requires a market-consistent representation of correlation among underlyings, which we achieve through a joint calibration that incorporates multiple stochastic processes.

The Numerix Hybrid Model Framework

Select desired models based on underlyings, and use them as building blocks for the hybrid model.

Using Your Proprietary Models with Numerix Analytics

Use your custom models side-by-side with Numerix models by integrating them with Numerix External Model API. This valuable feature allows support for one-off calculations tailored to specific instruments within a unified analytics platform.

Numerix Models by Asset Class*

Commodities

- Gabillon model

- Black model

- Schwartz 1F model with mean-reverting dynamics

- Gibson-Schwartz 2F model with stochastic convenience yield

- Heston stochastic volatility model

- Andersen model

- Estimating seasonality coefficients from historical data

- Support of rolling underlying future contracts

Credit

- Gaussian copula with optional correlated/stochastic recovery

- Student-T copula

- NIG copula

- Calibration of base correlations for various market conditions

- Dynamic credit models (top down)

- Dynamic credit model for pricing/hedging heterogeneous CDOs (bottom up)

- Advanced-factor models of credit baskets

- Multi-period simulations (Hull-White)

- Twisted Monte Carlo simulations

- Direct grid convolution

- Fourier/Laplace transform

- Asymptotic Saddlepoint methods

- Credit spread VaR

- Default VaR and Expected Shortfall for credit portfolios

- Cox-Ingersoll-Ross Model

Equity

- Anderson-Buffum model for liquid convertible bonds

- Black-Scholes model

- Dupire local volatility model, also with advanced fit of local volatility surface

- Heston stochastic volatility model with constant and time-dependent coefficients

- Bates stochastic volatility jump-diffusion model

- Local stochastic volatility model

- SABR model

- Quanto equity model

- Multi-factor BS/Dupire/Heston/Bates basket model

- Dupire (1F) and Heston (2F) models for equity index exotics

- Continuous or discrete dividends

- Vanna-Volga pricing method

- Fast low-dimensional PDE methods for Asian and Lookback options

- Analytic/PDE/tree/lattice/Monte Carlo

|

Fixed Income

- Deterministic (zero volatility) model

- Black model

- Hull-White (single/multi-factor)

- Black-Karasinski (one/two-factor)

- Shifted BK

- Libor Market Model (LMM)

- Shifted LMM

- Stochastic Volatility LMM

- N-currency LMM

- Multi-currency models with HW/BK models for IR components and BS/ Heston models for FX

- Longstaff-Schwartz method

- Analytic/lattice/PDE/trinomial trees/Monte Carlo

Foreign Exchange

- Deterministic model

- Black-Scholes/Garman-Kolhagen model

- Dupire local volatility model, also with advanced fit of local volatility surface

- Heston stochastic volatility model with constant and time-dependent coefficients

- Bates stochastic volatility jump-diffusion model

- Local stochastic volatility model

- SABR model

- Multi-factor BS/Dupire/Heston/Bates basket model

- Arbitrage-free volatility smoothing

- Continuity corrections for FX barriers

- Vanna-Volga pricing method

- Fast low-dimensional PDE methods for Asian and Lookback options

- Analytic/PDE/tree/lattice/Monte Carlo

Inflation

- Inflation Market Model (IMM)

- Heston IMM

- SABR IMM

- Jarrow-Yildirim model (generalized/cross-currency)

- Stripping of real rate curve from zero-coupon inflation-indexed swaps

- Support for CPI Index with seasonality corrections

- Analytic/generic tree/Monte Carlo

Hybrids

- Generic hybrid model framework using component models for interest rates, inflation, credit, equity, FX and commodities, with deterministic or stochastic components

- Correlations between different asset classes

- Joint calibration of all components

- Generic tree, forward and backward Monte Carlo

Life

- Lee-Carter Stochastic Mortality Model

|

Note: This is not a comprehensive list of all Numerix Models and Methods.