Aite Impact Report

The State of Capital Markets Post-Pandemic: Major Paradigm Shifts

A new report produced by the Aite Group, commissioned by Numerix, assesses the overall impact of an unprecedented pandemic on the securities industry, with particular focus around front-office dynamics, risk management, and the regulatory front.

The report is based on a study that interviewed, between July 1 and September 1, 2020, 30 market participants from 20 responding firms, representing executives from banks, asset managers, hedge funds, exchanges, and consultants. Through these interviews, the report sought to learn the trends and challenges borne by market participants in both the front and middle office as a result of disruptions caused by the COVID-19 pandemic.

In reading this report you will discover how prepared the financial services industry was for the COVID-19 pandemic, how risk systems are performing during the current environment as well as observed shifts in mindset. For example, the research shows how the adoption of cloud-based platforms will only accelerate as a result of the current crisis.

Key takeaways from the 21-page study include the following:

- An overwhelming number of respondents feel that the COVID-19 pandemic will expedite the adoption of electronic trading globally.

- An overwhelming majority of respondents agree that adoption of cloud or Software as-a-Service (SaaS)-based platforms will only accelerate as a result of the current crisis.

- One of the most encouraging outcomes of this pandemic has been how well trading operations adjusted to moving away from the office.

- The current work-from-home reality has had a humanizing effect on work-related relationships, as people are forced to make an additional effort to communicate better.

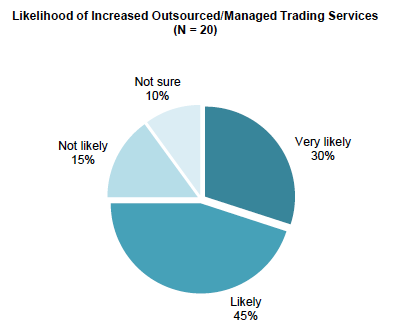

- In recent years, buy-side interest around outsourcing the trade function has also grown, and the majority of the respondents believe that the pandemic may accelerate that move.

- Many respondents point out the unprecedented market reality that various risk models and systems had to function despite the severe volatility faced by the global markets during the first couple of months of the pandemic-induced lockdowns.

- Overall, respondents agree that more time will be spent by all reexamining their risk management models to address flaws detected during the current crisis so that they can formulate new ways to mitigate future risk.

ABOUT AITE GROUP

Aite Group is a global research and advisory firm delivering comprehensive, actionable advice on business, technology, and regulatory issues and their impact on the financial services industry. With expertise in banking, payments, insurance, wealth management, and the capital markets, we guide financial institutions, technology providers, and consulting firms worldwide. We partner with our clients, revealing their blind spots and delivering insights to make their businesses smarter and stronger. Visit us on the web and connect with us on Twitter @AiteGroup and LinkedIn.