CrossAsset

Empowering insurers with market-leading analytics

Looking for derivatives analytics?

Explore our derivatives-focused CrossAsset page to learn more.

Industry-leading analytics library for insurers

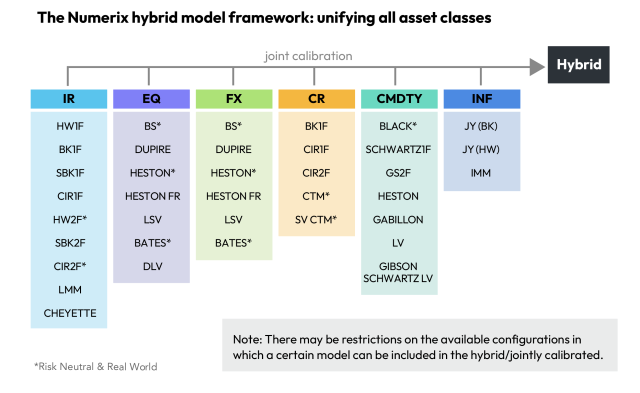

Over the past decade, the insurance industry has transformed, creating new opportunities and challenges for life and annuity businesses. Numerix CrossAsset empowers insurers with advanced analytics and insights to navigate this changing landscape. With a library of over 40 market-standard models across multiple asset classes, it offers unmatched flexibility for scenario generation, supporting pricing, hedging, and asset-liability management.

CrossAsset helps insurers manage complex products, adapt to market changes and regulatory demands, and optimize capital strategies. From product development to risk management, Numerix CrossAsset delivers the agility and precision needed to thrive. Whether your focus is capital optimization, liability management, or compliance, Numerix CrossAsset provides the tools for success.

Capabilities

Deploy capital in the most optimal way

Produce accurate liability and asset valuations for financial reporting and regulatory purposes, as well as Greeks and other risk metrics for Asset Liability Management

Robust capital market model libraries

Numerix CrossAsset is one of the most advanced capital market model libraries available, offering over 40 market-standard models across various asset classes. It enables insurers to simulate economic scenarios with precision for pricing, hedging, and asset-liability management. Built for complex derivatives and multi-asset portfolios, these models deliver accuracy in both risk-neutral and real-world scenarios.

Support the creation of innovative, market-driven products.

Numerix ESG’s custom scenario scripting empowers users to create tailored scenario indices, design innovative insurance products, and address multi-factor risks with confidence. This capability is vital for adapting to evolving market demands and supports insurers in exploring new markets or evaluating regulatory impacts.

Effortless automation and scaling

Numerix CrossAsset supports multiple programming languages like Python, C++, MATLAB, and Excel, boosting flexibility and streamlining workflows. Its scalable design lets clients start with basic setups and grow into advanced cloud-based workflows, enabling collaboration and automation across teams.

Structure and price any type of derivative or structured product

CrossAsset's hybrid framework seamlessly integrates multiple asset classes, mirroring real-world market dynamics and improving accuracy for complex financial products. Insurers can customize models, calibrate data using historical trends or projections, and adapt quickly to changing markets with precision and efficiency.

Benefits

-

Advanced modeling capabilities

Leverage the hybrid model framework to integrate multiple asset classes, capture market correlations, and support both risk-neutral and real-world scenarios.

-

Proven expertise and market leadership

Numerix CrossAsset has over 30 years of market presence and is trusted across all market segments. Our dedicated insurance team brings deep domain expertise, serving dozens of insurance clients.

-

Exceptional flexibility

Customize solutions to align with unique payoffs, regulations, and business goals with full control and transparency. Enjoy flexible tools to view and adjust model settings for precise scenarios. Use advanced scripting to create custom indices and payoff scripts, covering all OTC products, enabling accurate pricing and confident decisions.

-

Unmatched accuracy in pricing

Numerix CrossAsset delivers precise valuation for all hedging products, leveraging the widest set of capital markets models and methods. With comprehensive Tier 1 insurance and capital markets analytics, it empowers accurate and reliable pricing and risk decisions.

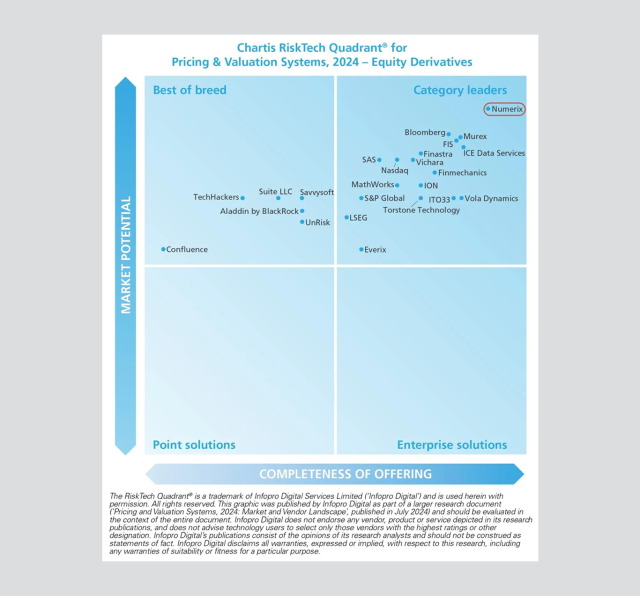

Numerix named a leader

In the 2024 Chartis Research RiskTech Quadrant® for Pricing and Valuation Systems, 2024 – Equity Derivatives

Capital markets awards that speak for themselves

Want to see CrossAsset in action?