Unlock the full potential of your convertible securities portfolio

The Kynex Portfolio Management System offers a powerful, intuitive solution for managing and analyzing convertible bond portfolios. Seamlessly build, monitor, and optimize your portfolio with a platform that combines Kynex’s industry-leading convertible securities analytics with comprehensive tools for portfolio maintenance, monitoring, and stress testing.

Unlock deeper insights with advanced metrics like Historical Value at Risk (HVaR), enabling precise and accurate risk evaluations. The system empowers you to identify new opportunities, manage existing risks, and gain a holistic understanding of your portfolio’s composition, distribution, and convertible dynamics—all while complementing your fundamental analysis.

Designed to optimize reward-to-risk ratios, the Kynex Portfolio Management System ensures your portfolio stays aligned with your investment strategy and guidelines. With its robust capabilities, it enables you to maintain a balanced, strategically optimized portfolio with confidence and ease.

Superior Performance, Exceptional Agility, Optimal Functionality, Satisfied Regulators

Capital markets firms are at a pivotal moment. Regulatory burdens are mounting, trading operations are being challenged, and legacy technology systems cannot meet expanding data analytics and compliance demands. Numerix offers the next generation technology solutions needed to help banks manage the complexities of the changing capital markets landscape, effectively manage risk and build a new competitive edge.

We know the challenges Front offices typically face. We have the experience, expertise and innovation to rapidly step in with flexible, high performance analytics, pricing, trading and risk management tools with cost efficiency and minimal interruption. With Numerix technology in place, your system will be enabled by a real-time, distribution, fault-tolerant, event-driven calculation framework that uses a dynamic dependency graph to maximize efficiency and throughput—thereby giving you the opportunity to outperform.

Capabilities

The Kynex Portfolio Management System combines all the advanced features of Kynex Core Analytics into a powerful platform for portfolio management and risk analysis. It retains Core Analytics' strengths while adding tools for portfolio maintenance, stress testing, and global market insights, offering financial professionals unmatched value and efficiency.

Arbitrage portfolios

We provide a comprehensive suite of greeks and hedging tools tailored for individual securities, security groups, or entire portfolios. Our customizable stress testing framework allows you to evaluate risk from your unique perspective with precision and flexibility.

- Access a full set of Greeks and hedges for individual securities or entire portfolios.

- Customizable stress tests to reflect your tailored risk perspective.

- Analyze long, short, and net market values by security type and industry.

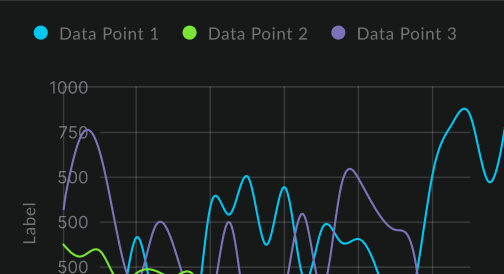

- Assess interest rate exposure and portfolio risk through graphical representations.

Long-only portfolios

Take advantage of portfolio-weighted valuation metrics such as yield, premium, investment premium, delta, and more.

- Benefit from portfolio-weighted metrics like yield, premium, and delta.

- Perform both top-down and bottom-up analysis of portfolio composition.

- Track portfolio sensitivity to equity markets, credit quality, market cap, and more.

- Upload custom benchmarks for delta-adjusted position comparisons across issuers, sectors, and credit qualities.

Want to see Kynex in action?

What our clients are saying

"A program I use every day. They're a core part of our business."

Asset Manager

"It's the pricing model we use pretty much for everything, whether it's for pitching, whether it's for live transactions or modeling."

Managing Director

"Any time a transaction is announced, it's on their website. You get the details very quickly."

Managing Director

"The fact that it's web based is very appealing. You can pull it up on your phone when you're traveling."

Asset Manager

"Responsive to our requests to make tweaks, to make it more customizable as our needs change."

Managing Director