Riding the Convertible Wave: Q3 2025 Sees Record Issuance & Market Momentum

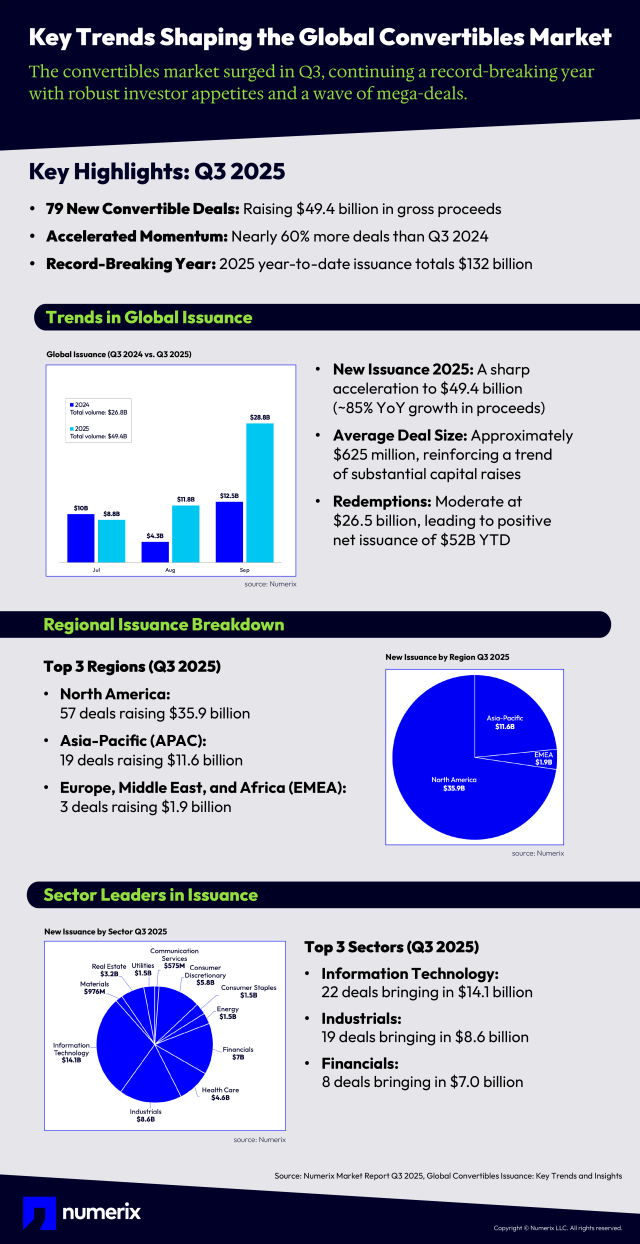

Following a strong first half of the year, the global convertible bond market continued to accelerate in Q3 2025, marking one of the most active periods in recent memory. With nearly $50 billion in new issuance across 79 deals, momentum remained robust, lifting year-to-date totals to $132 billion—already surpassing 2024’s full-year figure.

This sustained growth highlights a market that has not only rebounded but matured, as issuers and investors alike capitalize on convertibles’ dual appeal: equity upside and fixed-income stability. Supported by favorable financing conditions and ongoing risk appetite, Q3 further solidified 2025 as a record-breaking year for global convertibles.

New Research: Breaking Down Q3 Trends

In our recently issued market report, Q3 2025 Global Convertibles Issuance: Key Trends and Insights, we unpack the drivers behind the momentum — from sector-level trends and regional patterns to a closer look at the quarter’s standout transactions. Get a data-backed view of how convertibles are evolving as a strategic financing tool in today’s shifting market environment.

Key findings from this exclusive report are highlighted below.

Market Commentary

The global convertible bond market sustained strong momentum in Q3 2025, building on a record-setting first half. Issuance climbed nearly 60% year over year, with 79 new deals raising $49.4 billion in gross proceeds. The quarter’s performance reflected broad participation and continued confidence in convertibles as a flexible source of capital.

North America remained the dominant region, accounting for more than 70% of global volume, while Asia-Pacific nearly doubled its issuance from Q2, signaling its growing role in equity-linked financing. Sector activity was led by Information Technology, followed by Industrials and Financials, illustrating both growth-oriented and capital-intensive sectors leaning on convertibles to fund expansion.

A surge in zero-coupon structures underscored strong investor demand and attractive funding conditions for issuers, while the rise of dual-tranche deals reflected greater market sophistication. With positive net issuance and a steady flow of new entrants, Q3 demonstrated the depth and resilience of today’s convertible market.

As 2025 continues into its final quarter, convertibles remain a strategic financing tool amid shifting macro conditions—balancing investor appetite for upside with issuers’ drive for efficient capital.

Read the full report here: Q3 2025 Global Convertibles Issuance: Key Trends and Insights