Dawn of Alternative Reference Rates: Curve Construction Fundamentals

In the financial markets, curve construction is a fundamental component to everything from pricing and risk management to accounting. As new alternative reference rates, also known as the RFRs, or risk-free rates are coming into play, this poses a significant challenge to current IT infrastructure and curve construction practices.

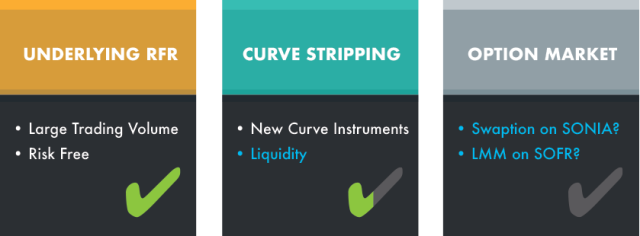

In this new 30-minute presentation, Ping Sun, SVP of Financial Engineering for Numerix CrossAsset tackles curve complexity under RFRs. He addresses this topic in three parts:

Part I: Introduction to RFRs and Curve Stripping: A Focus on SOFR

Part II: New Curve Instruments Observed in Today’s Market Based on ARRs

Part III: Market Best Practices in Constructing Curves and How They Can Be Applied to ARRs

Spotlight on SOFR: Where Are We Now?