Introduction to FX TARNs: Overview, Benefits and Real-World Applications

FX Target Accrual Redemption Notes (TARNs) have been a staple in financial markets since their inception in the early 2000s. These unique structured products combine high return potential with effective risk management, achieved through well-defined accrual and redemption mechanisms.

Over time, they have evolved alongside innovations in financial engineering and technology, becoming a popular tool in the FX markets for both hedging and investment purposes.

How do FX TARNs work?

FX TARNs are structured products that allow investors to trade one currency against another at pre-agreed rates while earning enhanced yields by selling options on a specified FX rate. The investor receives periodic premium payments until a cumulative payout target is reached (a “knock-out”) or the product matures. If the FX rate breaches defined barriers, the investor may be required to exchange currency at less favorable terms, resulting in potential losses.

Amid heightened global currency volatility driven by geopolitical events, trade tensions, and shifting economic conditions, FX TARNs offer a cost-efficient way to manage FX exposure. They can be used to hedge against adverse currency moves, enhance yield, and align strategies with evolving market forecasts—making them a flexible tool in today’s dynamic financial environment.

Use Cases for FX TARNs

FX TARNs cater to specific needs in currency risk management and speculative positioning. Here are a few reasons why these products are particularly attractive to market participants:

Enhanced Return Potential: FX TARNs enable participants to lock in rates better than the prevailing market. When FX movements remain minimal within the predetermined strike zone, participants maximize their payouts.

Strategic Hedging: For corporates dealing with recurring cash flows across borders (e.g., imports and exports), FX TARNs offer fixed and often favorable rates for future transactions. This makes them an efficient alternative to buying multiple FX forward contracts.

Cost Efficiency: FX TARNs are typically structured to have no upfront premium, making them an attractive tool for hedging predictable currency flows without initial capital outlays. However, this cost efficiency comes with embedded risk—returns are capped and potential losses are magnified by leverage when market conditions move unfavorably.

Flexibility for Speculation: Sophisticated investors, such as private banks, deploy FX TARNs to capitalize on short-term currency views in range-bound markets. The knockout feature allows early exits once target returns are achieved.

Real-World Payoff Example

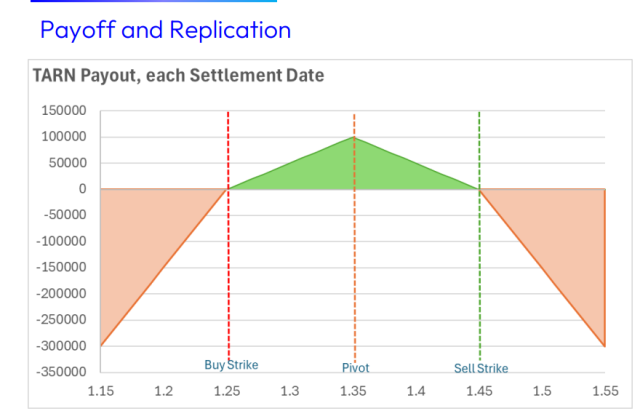

The chart below visualizes a typical FX TARN payout structure, highlighting buy strikes, sell strikes, and pivot points. In this scenario, an FX TARN is structured on the USD/SGD currency pair. If the USD/SGD rate fixes at 1.26, the participant purchases 1,000,000 SGD at the agreed buy strike of 1.25, resulting in a cost of 800,000 USD. However, if the FX rate drops further to 1.21—below the buy strike—the notional is leveraged, and the participant is required to buy 2,000,000 SGD at the same rate of 1.25, costing 1,600,000 USD. This illustrates the built-in leverage mechanism that amplifies exposure when market rates move beyond defined thresholds.

On the other hand, if the FX rate fixes above the pivot, the participant is required to sell the term currency at a predefined sell strike. Similar to the buying example, the notional used in the transaction depends on the FX rate's proximity to the sell strike. If the FX rate is below the sell strike, the notional amount applies. If the FX rate is above the sell strike, a leveraged notional kicks in.

In the above chart, we can see a central “green” profit zone between the buy strike and sell strike, with losses occurring in the “orange” zones when the FX rate moves outside these boundaries. The payoff shape reflects the leveraged nature of the product and the asymmetric exposure to FX rate movements, making FX TARNs a complex but potentially rewarding instrument for managing currency risk or taking directional views.

Unlocking the Potential of FX TARNs

FX TARNs can be a useful tool for enabling market participants to hedge currency exposures or speculate on stabilizing FX rates. Their combination of low initial costs, enhanced returns, and flexibility makes them a preferred product in certain economic environments.

However, these instruments are complex, requiring careful consideration of their risk-reward trade-offs. For those looking to leverage the benefits of FX TARNs, partnering with platform providers like Numerix offers access to advanced pricers, models, and analytics that can help you simplify FX TARNs investing.

Looking to explore FX TARNS in further detail? Watch the comprehensive on-demand webinar, Demystifying FX TARNs: From Pricing Challenges to Risk Management.