Record-Setting Convertibles Issuance Signals a New Era for Equity-Linked Financing

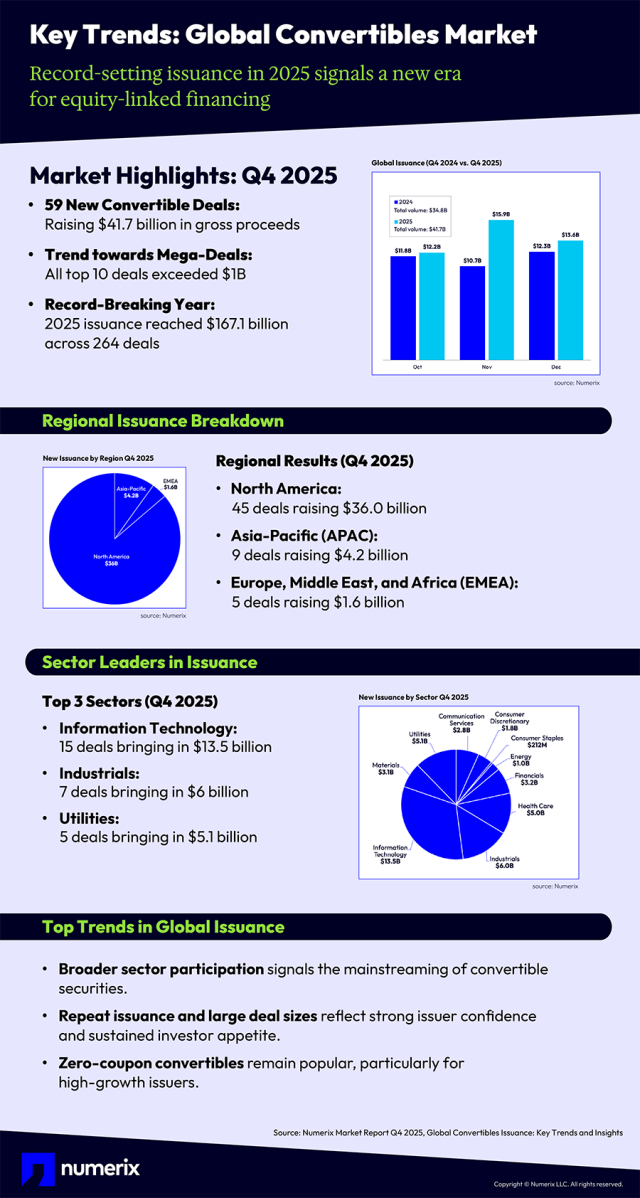

The global convertible bond market closed 2025 with exceptional momentum. Issuance reached $41.7 billion— up 20% year-over-year from $34.8 billion in Q4 2025— pushing full-year activity to levels not seen since the 2020–2021 surge, when convertibles reached historic highs.

This acceleration reflects a powerful mix of resilient investor demand, constructive equity markets, and increasingly sophisticated issuer strategies. In total, 2025 global issuance reached roughly $167 billion across 264 deals, marking the strongest year on record and underscoring convertibles’ growing role as a mainstream corporate financing instrument.

New Research: Breaking Down Q4 Trends

In our recently issued market report, Global Convertibles Issuance: Q4 2025 Key Trends and Insights, we unpack the drivers behind the momentum — from sector-level trends and regional patterns to a closer look at the quarter’s top ten transactions. Get a data-backed view of how convertibles are evolving as a strategic financing vehicle in today’s shifting market environment.

Key findings from the report are highlighted in the infographic below.

Convertible Market Outlook

The convertible market has entered 2026 with continued strength, with U.S. new issuance projected at $80–100 billion, according to the Numerix report — well above long-term averages and reinforcing convertibles as a core corporate financing tool. A key driver will be the 2026–2027 maturity wall across both convertible and high-yield markets. As issuers confront higher refinancing costs, convertibles offer an attractive way to extend maturities while limiting cash interest and preserving balance sheet flexibility.

M&A activity is also expected to support volumes, with fast-growing companies increasingly using convertibles to fund acquisitions. Investor demand remains resilient, supported by persistent volatility, solid equity performance, and steady inflows into dedicated convertible strategies.

Get further insight and details on expectations for the year ahead in our exclusive market report: Global Convertibles Issuance: Q4 2025 Key Trends and Insights