Zero-Coupon Convertibles are Surging. Here’s Why.

The corporate finance landscape is evolving. For decades, companies balanced traditional debt and equity, weighing interest costs against shareholder dilution. More recently, one instrument has taken on an increasingly prominent role in capital raising: the zero-coupon convertible bond.

In Q3 2025, zero-coupon structures accounted for more than half of the largest global convertible deals, signaling a structural shift in how large issuers are approaching capital formation.

While convertibles have long been favored by growth-oriented sectors such as technology, the recent rise in zero-coupon structures marks a meaningful shift. No longer confined to niche or distressed situations, these instruments are now being used by large, established issuers as a strategic financing tool.

The Quiet Rise of the Zero-Coupon

What’s behind the growing appetite for debt that carries no interest payments? The answer lies in a convergence of strong investor confidence, disciplined corporate capital planning, and market conditions that reward equity-linked structures.

A zero-coupon convertible bond pays no periodic interest to investors. Instead, returns are driven by the option to convert the bond into equity at a premium, or by repayment of principal at maturity, often following issuance at a discount.

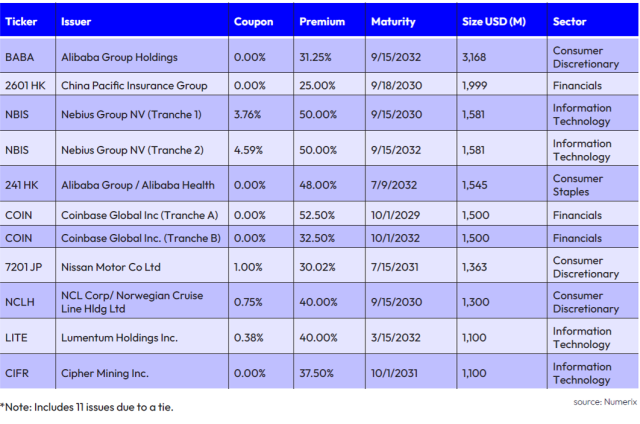

According to Numerix’s Q3 2025 Convertibles Issuance Report, zero-coupon convertibles had a breakout quarter, generating approximately $20.9 billion in net proceeds. More than half of the largest deals (outlined below) carried a 0.00% coupon—well above levels typically seen in past cycles. This shift reflects both robust investor demand and issuers’ ability to secure capital on highly attractive terms.

Top 10 Convertibles Deals (by Size)

Why Issuers Are Flocking to Zero-Coupons

For corporate treasurers and CFOs, the appeal of zero-coupon convertibles is clear: cash flow preservation.

Traditional debt requires ongoing interest payments, which can weigh on liquidity. Zero-coupon issuance eliminates that near-term cash burden, allowing companies to deploy capital toward growth initiatives such as R&D, acquisitions, or expansion.

This dynamic was particularly evident in the Information Technology sector. In fact, the Numerix report highlights several large-scale transactions, including Alibaba Group Holdings’ $3.168 billion zero-coupon convertible and Coinbase Global’s two tranches totaling $3 billion, both issued at 0.00% coupons.

When companies of this scale can raise billions without committing to annual interest payments, the economics of capital formation shift meaningfully—especially for issuers with compelling equity narratives.

The Investor Perspective: Why Buy a 0% Bond?

For investors, the attraction to zero coupon convertibles lies in equity optionality rather than income. These unique instruments offer asymmetric payoff profiles: participation in upside if the issuer’s stock appreciates, with downside protection provided by the bond’s principal value at maturity.

The broader market environment has been particularly supportive of zero-coupon convertibles. In periods of strong equity sentiment, investors are often willing to trade regular interest income for the potential upside of converting a bond into shares. This demand for “hybrid” exposure—combining downside protection with equity participation—has made zero-coupon structures especially attractive in growth-oriented sectors such as technology and consumer markets.

Conversion premiums further illustrate this dynamic. A conversion premium represents how much a company’s share price must rise before investors choose to convert their bonds into equity. In Q3, Alibaba’s zero-coupon deal carried a 31.25% conversion premium, while Coinbase’s tranches featured premiums of 32.50% and 52.50%. By accepting both a 0% coupon and elevated conversion thresholds, investors are signaling strong confidence that these companies’ stock prices can outperform those levels over the life of the bonds.

Rising Deal Complexity Through Dual-Tranche Structures

According to Numerix’s Q3 data, another key trend has been the growing sophistication of convertible issuance. Several of the top 10 deals by size, including Coinbase, featured dual-tranche offerings with distinct maturities and structural terms, often pairing a shorter-dated tranche with a longer-dated structure to address multiple funding objectives within a single transaction.

This approach enables issuers to diversify their investor base, stagger maturity profiles, and manage refinancing risk while fine-tuning their overall capital structure. The prevalence of these deals highlights how convertibles—particularly zero-coupon formats—are increasingly being deployed as precision financing instruments rather than opportunistic alternatives, reflecting a more deliberate and strategic use of the market by corporate issuers.

Reshaping Corporate Finance

The surge in zero-coupon convertibles in Q3 2025 reflects more than short-term momentum. It highlights a broader shift in how companies approach capital raising, particularly those with strong equity stories and global investor appeal.

By aligning issuer objectives with investor demand for growth exposure, zero-coupon convertibles have emerged as a powerful mechanism for raising large-scale capital efficiently. As long as equity markets remain receptive, these instruments are likely to remain a central feature of the corporate finance toolkit.

Read our full Q3 Convertibles Issuance report here. Also, be sure to look out for our Q4 report, which will deliver insight into the quarter’s biggest trends and a market outlook for the year ahead—coming in late January 2026.