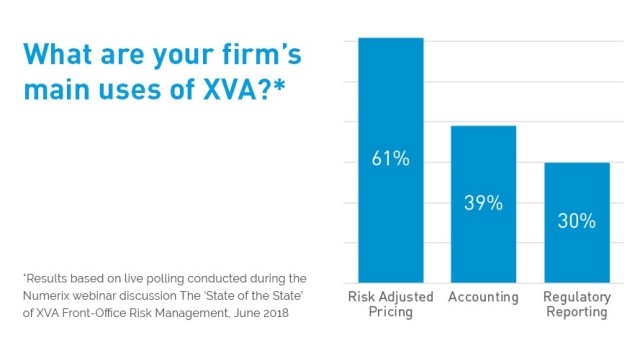

The Current State of XVA Adoption

XVA has been of great interest—and of equally great concern—to OTC derivatives market participants in recent years due to increasing awareness of the heavy costs, capital requirements, as well as the implementation and management challenges involved. Participants are particularly nervous about the sheer number of valuation adjustments that threaten to impact the profitability and viability of their derivatives businesses. Additionally, practices in trading, risk management, accounting and regulation of OTC derivatives continue to evolve in response to what seems like an ever-changing environment.

In this XVA forum, Numerix features a panel of industry leaders who assess the major factors surrounding XVA adoption today, and offer their expert insights and points of view on the following:

- The different states of maturity and gaps in XVA adoption on an institutional and regional level

- The most dominant XVA management challenges facing the market today

- The long-run benefits of pricing in XVAs now rather than waiting

- The workability of optimizing and hedging XVA costs

- The core factors to consider when setting up an XVA desk