Resilient & Rising: How the Convertibles Market Evolved in Q2 2025

The second quarter of 2025 was marked by significant shifts in the global convertibles market, shaped by macroeconomic catalysts and evolving issuer strategies. From a turbulent April to a renewed surge in activity by June, market dynamics changed rapidly. How have these shifting dynamics affected issuance trends, pricing behavior, and investor demand in the convertibles market?

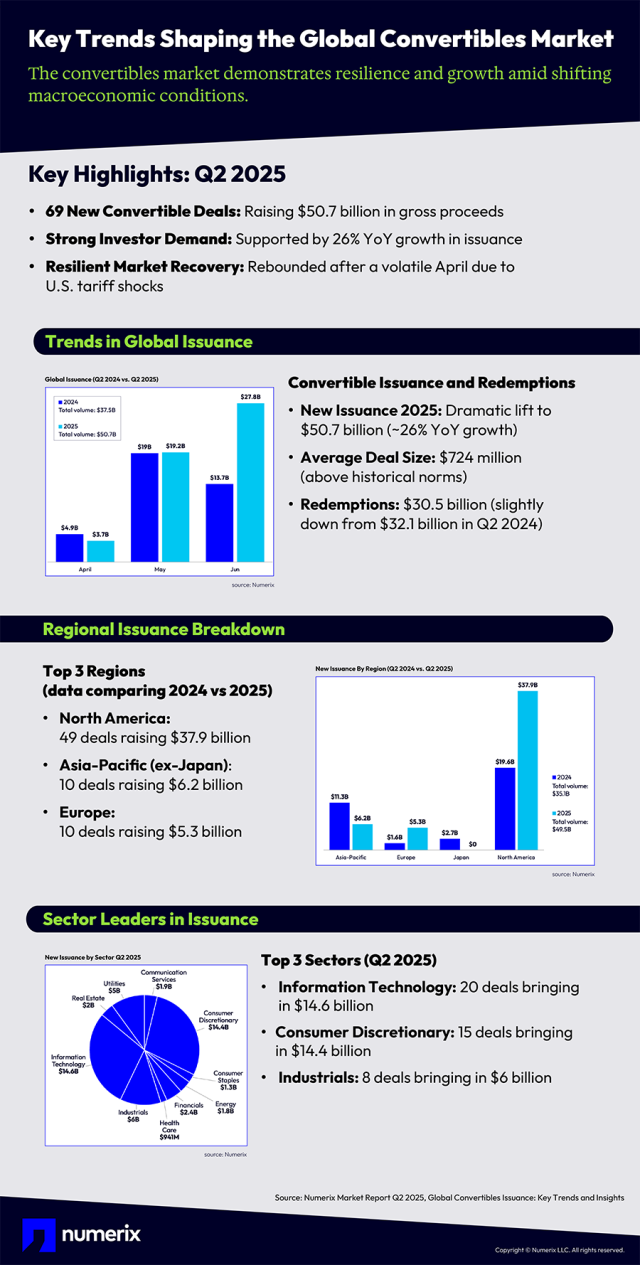

In our recently issued market report, Global Convertibles Issuance: Key Trends and Insights Q2 2025, Numerix examined the latest trends shaping the convertibles landscape, including regional issuance patterns, sector highlights, and the strategic motivations driving issuers. Supported by data into top deals and year-over-year performance, our analysis gives insight into how the convertibles market continues to evolve as an essential financing instrument.

The infographic below illustrates key findings from this exclusive report.

Market Commentary

All in all, the convertible bond market demonstrated remarkable resilience in Q2 2025, rebounding swiftly after a tariff-induced freeze in April. Issuance surged in May as trade tensions eased and market conditions stabilized, with over $19 billion raised—more than double April’s total. This resurgence not only underscored the market’s sensitivity to macro catalysts but also highlighted its ability to adapt quickly when conditions shift.

Key trends point to a structural evolution in the market: a broader range of issuers beyond tech—including consumer, utility, and industrial names—embraced convertibles, while the volume of megadeals ($1B+ issuances) reached unprecedented levels. Favorable pricing dynamics, supported by strong demand and elevated interest rates, further fueled activity. As volatility persists and investors seek yield with embedded equity upside, convertibles are increasingly viewed as a mainstream capital markets tool rather than a niche financing option.

For deeper insights into this topic, please see our market report: Global Convertibles Issuance: Key Trends and Insights Q2 2025